I’ve learned a lot about accounting, tracking inventory, and doing taxes for a Norwex business over the years, since my wife has been a Norwex consultant since 2013.

In the beginning, we had no plan for her accounting because she didn’t plan on sharing Norwex as a business. Like many consultants, she signed up for the discount.

When she started treating Norwex like a business, we quickly realized that we needed to get serious about tracking her income and expenses.

Otherwise, we’d continue paying more (yep, you read that correctly, continue, as in we were already paying more than needed) of her earnings away in taxes than we wanted to (really who wants to pay any, right?!).

So that’s essentially how Direct Sidekick started, from filling the need to find the easiest way of accounting for her Norwex business.

Here is the complete guide to doing your taxes for Norwex consultants. If you’d like to automate much of this, you can give our Norwex accounting software a try.

To make this guide as easy as possible to follow, I’ve organized it in a questions and answers format and based it on the questions we receive the most from Norwex consultants.

If you don’t see your question in the list, please ask it in the comments. We’ll respond to you as soon as possible and update the article.

Let’s Start With The Basics

Do I have to claim my Norwex earnings on my taxes?

Per IRS code, you must claim all money you received from selling Norwex, no matter how much. Your earnings include what is shown on your 1099 and any sales commission you earned.

When and how do I get my 1099 from Norwex?

If Norwex has paid you more than $600 or you’ve purchased more than $5,000 in products, Norwex will mail you a physical copy of your 1099 by January 31 (unless January 31 falls on a weekend).

What’s included in my 1099 from Norwex?

Well, let’s start with what’s not included in your 1099. Your 1099 does not include your commission earned on your party sales, web orders, or personal sales.

What we call a commission, Norwex considers a discount, so it does not appear here. Instead, you must track how much you earn from your business which includes your sale commissions on your own (hint: Direct Sidekick can help with that!).

What does show up on your 1099 is your manager commissions (downline commissions), Choice Rewards purchases, and other incentives earned, including that nice swag and incentive trips.

What is income?

Here is a list of things considered income for your Norwex business:

- Downline commission

- Party, web order, and personal sales commission

- Income from the sale of free products, which includes free products from incentives as well as shopping sprees

- Incentive trips

- Choice rewards purchases

Do I have to provide my assistant with a 1099?

If your assistant is a contractor and not an employee and you’ve paid them $600 or more in the last year, you must provide them with a 1099.

What Are My Norwex Tax Deductions?

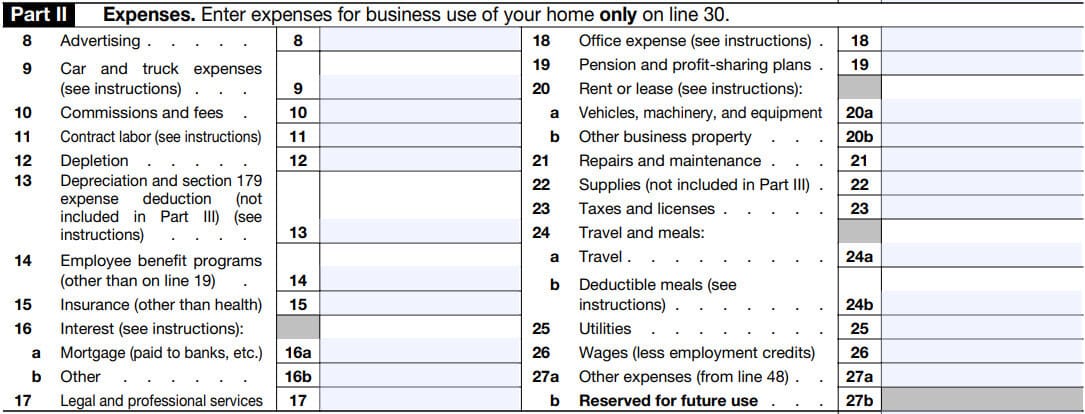

What tax deductions are available for my Norwex business?

We have an entire article dedicated to what you can deduct from your taxes here.

Beyond that, we receive the following questions specifically from Norwex consultants who trust Direct Sidekick for their accounting.

Can I deduct my expenses for the annual conference?

Yes, as you are attending the annual conference to learn, build your team, and grow your business, this is a business expense!

You can deduct your travel expenses, including costs for:

- Airfare

- Mileage if driving

- Hotel

- Taxi rides

- Parking

- Food and drink

- Conference ticket

Can I deduct the annual incentive trip?

I’ve heard some consultants tell others you cannot deduct this.

But here is the correct answer verified by our CPA: since Norwex incentive trips include meetings, training, and other business activities, as long as you attend these business activities, you can deduct the incentive trips as a tax deduction.

You can find the amount to deduct from your Norwex tax information in your back office under My Business -> Tax Information.

Then scroll down and click the Incentives, Gift Prizes & Awards button. The retail value, which you can deduct, is shown on this list.

What type of deduction is the back-office fee?

Like other programs you may use to run your business, the back-office fee is an office expense.

What mileage can I write off?

If you’re doing home parties or vendor events, mileage can be one of your most significant tax deductions.

Assuming you’re using your home as a home office, you can deduct your mileage when driving for the following:

- To and from parties

- To and from vendor events

- To the post office to send host packets, prizes, etc.

- To pick up office supplies

- To pick up party or team meeting supplies

- To deliver products to your customers

- Pretty much anywhere you drive for your Norwex business!

Can I write off discounts or free shipping I offer to my customers?

You can deduct this if you are paying for the shipping or part of your customer’s order (essentially giving them a discount). Both can be entered as supply expenses.

To be clear, this isn’t paying from your commission which lowers your earnings for the order; this is when you pay your customer’s shipping or part of their order on your card on file.

This is one reason I suggest always paying the party balance with your cards on file and not with commissions earned.

Another reason is that if you pay with your balance, your customer doesn’t see the discount applied to their order which, in our experience, can lead to confusion for your customer.

I’m new to Norwex. Can I deduct my starter kit?

Yes, you can! Your starter kit consists of business supplies and products for you to demo, share, and learn from; you can deduct this as a supplies expense.

Can I write off donations?

You can deduct donations that are donated directly to a 501(c)(3) organization as a donation expense.

However, you must write out the check for the donation to the named organization and not an individual.

If you are gifting products or giving your commission to someone to gain new customers, increase sales, etc., you can write that off as an advertising expense.

Can I deduct expenses for team meetings?

You can deduct your expenses for hosting team meetings. These are great for getting engagement, education, and enthusiasm!

You can write off all of your costs for these events.

Can I deduct products I give away or use myself?

Products you give away to grow party sales, incentivize bookings, or other marketing-related reasons can be deducted as advertising expenses.

Products you remove for personal use are not tax-deductible.

We have an entire article about accounting for giveaways, demo products, and personal use of inventory here.

Can I deduct my demo bag and supplies?

Yes, you can deduct your demo bag and demo supplies. These are considered advertising expenses as this is how you demonstrate and share Norwex at your parties!

Step-By-Step Guide to Managing My Norwex Inventory

Do I need to track my inventory?

According to the IRS, you must “use a method of accounting for inventory that clearly reflects income.” How will you accurately account for your income and expenses without tracking inventory?

So yes, if you hold inventory for resale, it is a good idea to track it. Remember that cost of goods sold (COGS) is a tax deduction.

How do I manage my Norwex inventory?

Managing your Norwex inventory doesn’t have to be complicated. If you use Direct Sidekick, it’s actually a breeze.

The first thing to do is connect the bank account and credit card you use for your Norwex business.

Once this is done, Direct Sidekick automatically imports and categorizes your posted transactions five times per day.

Next, follow the table below for when to enter purchases, invoices, and adjustments in Direct Sidekick.

| If this happens | Do this in Direct Sidekick |

|---|---|

| I place a party order, and my customer’s payments are all entered into the back office. | No need to do anything in Direct Sidekick. You will enter “Income” transactions when you are paid your earnings from your company. This will include your commission from this party/sale. |

| My customer pays me directly for an order I place for them in my back office. Then I pay my company from my bank account or credit card on file. | Since your customer paid you directly and you deposited the funds into your bank account, enter an income transaction. Then when you pay your company for their order, enter that transaction as a “Supplies” expense. |

| I purchase products only for personal use. | This order is separate from your business and should be purchased using a personal account with nothing entered into Direct Sidekick. |

| I place an order to add items to my inventory for resale. | Enter a purchase in Direct Sidekick, which adds your items into your inventory with your actual costs as your item costs. This gets your items into your inventory and allows Direct Sidekick to calculate your cost of goods sold (COGS) accurately. Do not add a separate expense transaction for the purchase. |

| I host my own party and receive the host rewards to purchase items for my inventory. | Enter a purchase in Direct Sidekick, which adds your items into inventory. If the host credit was added to a specific item, discount that item for the credited amount. If your host credit was added to the entire balance, add the discount next to “other discount.” |

| I received free products from my company-for example, incentives or rewards. | You have options here:

|

| I order business supplies or samples. | Enter a “Supplies” expense in your transactions list. If business supplies or samples are added to a regular inventory purchase, enter the purchase, as usual, including these items, and uncheck the Inv. checkbox. This automatically adds a PO supply order transaction for you. |

| I sell items from my inventory. | Add an invoice for the sale to remove the items from your inventory. Check the “add to income” checkbox to add the total to income. The preferred method is to leave this unchecked and enter an income transaction when the payment is deposited into your bank account. |

| I give items away for business purposes or take items from my inventory to demonstrate (in person, video, etc.). | Enter an adjustment in Direct Sidekick and choose the “demo/advertising/give away” purpose. |

| I remove items from my inventory for personal use. | Enter an adjustment in Direct Sidekick and choose “personal use” as the purpose. |

| I pay my customer’s shipping and/or for part of her order to give her a discount. | Enter a “supplies” transaction in the amount of the payment. |

After following the table above, and connecting your bank account, there’s only one thing left to do.

Since Direct Sidekick is automatically importing and categorizing your transactions, you’ll need to go to your transactions list and update the category for the transactions for purchasing the products (your “personal inventory for resale”) to the Inventory Order Payment category.

Otherwise, you write the products off twice, which is a big no-no.

How do I calculate cost of goods sold?

Cost of goods sold (COGS) can be a complicated calculation if you try to figure it out on your own. This is mainly due to all of the different costs included in receiving your products. Think shipping and tax.

Another reason is that sometimes you may receive your standard discount while other times you may buy products with a 40% discount.

With flash sales, and other deals to get extra discounts, that means a lot of different prices for the same items.

Direct Sidekick handles all of this for you!

Direct Sidekick allocates a portion of shipping and tax to each item and uses the weighted average cost when calculating cost of goods sold.

The calculation for cost of goods sold is but you don’t have to worry about that as Direct Sidekick offers a full COGS Report:

Beginning inventory – adjustments + inventory added – ending inventory = cost of goods sold.

What do I do with products I get for free?

Free products are the best, aren’t they?! There’s more than one option for handling them for your accounting.

One of the most popular ways I’ve seen is to put stickers on the free items to keep them separate. Then, when you sell them, add an income transaction for the payment (remember, if you connected your bank account, you don’t have to do this. It’s done for you!)

Another common way of tracking free products is to add a separate SKU number in Direct Sidekick, adding an “f” for free to the end of the regular SKU. Then add and remove the items as usual.

Other consultants enter them into their inventory the same way as their other products.

The main thing to remember is to set up your system that gets done and do the same thing every time.

General Business and Tax Recommendations

Do I have to remit sales tax to my state?

If you charge your customer sales tax that purchases directly from you, from your inventory (not party sales), you must keep track of and remit sales tax to your state.

You will need a sales tax ID from your state.

When charging your customers for a product from your inventory that you’ve already paid the tax for, you can add a handling charge instead of charging tax.

How should I pay the party balance when I close a party?

In our experience, paying with the card on file with Norwex makes everything so much easier to track and manage.

If you pay with your commissions, it actually makes more work for you regarding tracking your income.

If you ever pay for shipping or for part of your customer’s order (to discount the order), you can deduct the expense if you use your card on file for the payment.

If you just reduce your commission earned for the discount, that isn’t an expense; it’s just a lower commission earned.

Should I use a separate bank account for my Norwex business?

This is a must! Open a separate checking account and use that for all of your business purchases and expenses. This achieves a couple of things. First, it keeps all of your transactions in one place.

Next, it keeps things separate, making things much easier if you are ever audited.

Are there any other benefits to owning my own business?

There sure is! Sharing Norwex is your own business.

You can make as much as you want.

You can work the hours that work best for you.

You can write off part of your home and mileage used for business.

Beyond that, though, there are some great options for using your business to boost your retirement savings.

For example, there are retirement accounts that allow you to save and write off up to 30% of your business income! If you are looking for options to maximize your savings and minimize your business taxes, I suggest speaking with a qualified Financial Advisor you trust.

Norwex Vendor Events

What can I write off when doing a vendor event?

I love vendor events! Where else do new customers walk right up to you and ask you to tell them about your great product?

My family has done vendor events for Norwex all over the country, and we’ve had great success. We were happy with the results from sales, new customers, and new recruits!

So, what expenses can you deduct when you do a vendor event?

- Your travel costs. This included hotel stays, mileage, food, beverage, etc.

- Your vendor fees

- Costs to purchase tables or table rental fees

- Any table décor you purchase to add some splash to your display

- Demo products

How do I take payment at a vendor event?

It’s always a good idea to have cash at the event to make change when a customer wants to pay with cash.

It’s also advisable to have the option to take payment via credit or debit card at the event—the more options your customers have to pay you with, the better.

We use and highly recommend Square for this. You get a square reader that connects to your mobile phone to swipe your customer’s credit or debit cards at the event.

How do I do a shared vendor event?

Sometimes a vendor event is just too big or too expensive to do on your own.

But don’t pass up an opportunity because of that.

Instead, reach out to someone on your team to share the event.

If you can’t find someone on your team, look to other teams, so you don’t miss out. That way, you can split the costs, customers, and bookings.

I can’t stress enough to have an agreed plan on how you want to handle inventory and customers before you get to the event to make sure you’re on the same page as the other consultant.

Typically, both consultants will collect sales on their own, selling any available inventory.

If you sell the other consultant’s merchandise, you replace it for them.

Or you can pay them the replacement cost (after discount) instead if the other consultant is happy with that.

Essentially, they are paying you the 35% commission to sell their product for them.

Some consultants are good with that, and others prefer their products to be replaced.

The same thing is typically used regarding new customers and bookings.

If you work with a customer, she’s yours.

If the other consultant works with a customer, then, of course, that customer is theirs.

If you have any lead generation ballots (prize drawings, etc.), those get split evenly between the consultants. So again, it is vital to have an agreed-upon plan before the event.

Here’s a great article for having great vendor events!

Conclusion

Norwex is a great business to be in! My wife has been a Norwex consultant since 2013, and it’s been such a blessing to our family. We made Direct Sidekick for her and for you to make your accounting quick and easy for your Norwex business.

Still have questions? Ask them in the comments section below, and we’ll answer them ASAP!

FYI: Direct Sidekick is accounting software built for direct sellers, network marketers, crafters, vendors, VRBO owners, and many other home-based business owners. Create an account and start tracking your income, expenses, and inventory.

Your product sounds great! I am currently using a different system, and I’m wondering if it would be worthwhile moving over to your system now (October) or wait until the new tax year. If I changed now, can all the data for the whole year be imported from my Bank and Credit Card? And if I did import it, how big of a job would it be to categorize it all

Hi Genny & Derek! Thank you! It is definitely worth moving over to Direct Sidekick any time. We have a process set up to help you transition quickly. Since you are coming from another system you can import your existing transactions OR you can email your transactions to us, and we’ll import them for you and make sure the categories match up.

When you connect your accounts for the first time, we ask for a starting date that you’d like us to import your transactions from. We attempt to import and categorize all of your transactions back to that date. The amount of transactions we’re able to import depends on the bank or credit card with some allowing us to import two years’ worth of transactions while others allow a shorter amount.

It is very quick to categorize your transactions. Essentially, you can search for a company or description, check all of the checkboxes for them, and change them all to a new category at the same time.

You can sign up for our free 14-day trial here. Once you do, we’ll reach out to you ASAP to help you get your data moved over.

Can I use Direct Sidekick if I am in Canada?

Hi Karen! Thank you for your question! Yes, Direct Sidekick will work with you in Canada. We have customers in Australia, Canada, and the United States. You can sign up for our free 14-day trial here.

Hello! Thank you for this article and the one on tips for Vendor events! I am still a little uncertain how sales tax works for my upcoming vendor event. Because I already paid sales tax on my personal inventory to Norwex, when I go to set prices for my event, I could include an upcharge of sorts as a “handling fee” to reimburse myself for these expenses without having to remit additional sales taxes to my state? Thank you again for the article and any help you can provide on my question.

Hi Stephanie! Great question that we receive all the time. This is definitely a confusing question that most companies don’t help their consultants with. Sales tax is paid once on a product. So, if you paid it already, you don’t charge it to your customer and remit it to your state. When you sell your products, you can definitely add a markup to cover your costs. This is very common. If you don’t, you’re not earning as much on your sales as you expect.

That’s also why inventory management, using accurate cost information is SO IMPORTANT to your business. We’ve seen so many consultants NOT earning as much money in their business as they thought due to not covering all of their costs when they sell their inventory.

I see you recommended that purchases for personal use should be separate from the business, but it doesn’t make sense to me to do a separate order, because that results in paying almost twice the shipping costs. I would prefer to continue doing what I currently do, which is to combine my personal use items and my customers orders onto one direct order and properly track both (by not expensing the personal use items). Can Direct SideKick help if I choose this path or no? Or is there more to the recommendation that I may not be considering?

Hi Michelle! Great question! If you are referring to the table above, we recommend keeping the order separate if it is for ONLY personal use items. Meaning, if you are placing an order where ALL of the items are for personal use, this should be done using your personal payment account and not be entered into Direct Sidekick.

As you mention, and in our experience, this rarely happens this way. Most of the time the order is combined with products for your business (for resale or giveaways). As you said, with these orders it’s best to combine them into one and save on shipping. Any time we can save money on an order is a good thing!

Direct Sidekick makes this easy. You can use a personal use adjustment to remove your personal use items.

I just earned a $250 shopping spree through Norwex. I plan to use this amount to purchase supplies (catalogs, samples, etc) but also product to give away as prizes during my parties. Does this get documented then twice. First as income, since I received this amount for my use. Then again as a supply order? If I decided to use part of this to purchase personal items, that portion would be left out of the ‘supply order’ amount?

Can I use this program WITHOUT linking it to my banking accounts, but rather enter everything manually?

Hi Joanne! Thank you for your question! This answer is based on my understanding that the $250 shopping spree is included on your 1099. You’ll use your cost for the supply order or inventory purchase. Meaning, you’ll use the value on your 1099 as your product cost. So, your $250 will be income, and you’ll be writing off the supplies. Correct, if you use some of it on personal items, those are not deductible.

YES, you can use Direct Sidekick WITHOUT linking your accounts. We have three ways to enter your transactions, automatically by connecting your accounts, CSV import (monthly?), or by filling out a quick form to add them individually. You can use whichever way works best for you and your business!

You can sign up for your free trial here.

How do you find the catalog expenses you’ve paid and I’m assuming those would be a write off as well?

Hi Beth! From speaking with our customers that are Norwex consultants, I’m told that there are a couple of ways of placing orders for catalogs. One is adding them to a regular product order and the other is a a personal business supply order. You may be able to search your order history for supply. I would recommend calling Norwex customer support to find out how to get a list of your business supply/catalog orders if it’s available.

You are correct that these are deductible supplies expenses for your Norwex business.

The easiest way to keep track of this and not have to scramble around at tax time is to use Direct Sidekick to always have your books in order throughout the year in just 15 minutes per month. You can start your 14-day free trial here.

What do you do about the products you earn when you host your open party? Do you count them as income. If it says you earned $463 of Norwex products for only $23. You saved $440. Which of these 3 numbers do you use? Or do you add up all of the free products at retail value and consider that income? Thanks.

Hi Charlotte! Great question. According to IRS Publication 525, “If you host a party or event at which sales are made, any gift or gratuity you receive for giving the event is a payment for helping a direct seller make sales. You must report this item as income at its FMV.” As always, you can discuss this with your CPA.

When adding income, do you put in every single order, or do you just record the commission that is paid into your account when it is put into the account?

Hi Debbie! Great question! You do not need to record each order individually. You can add your income when you’re paid twice monthly by Norwex. Then add any cash, check, PayPal, Venmo, etc. deposits when they’re earned. Using Direct Sidekick, this is all automated for you.

Good morning. I was wondering if this program can be used by Canadians. It seems really straight forward, but our tax laws are different.

Thanks.

Carolyn

Hi Carolyn! Yes, Direct Sidekick can and is used by Canadians! Think of it as a program that automatically imports and categorizes your transactions and helps you manage your inventory. When it’s time to do your yearly taxes, all your info is accurate, ready, and in one place! You can start your free 14-day trial here!

Can the monthly expense for Direct Sidekick be written off as a business expense?

Hi Shannon! That is correct, the expense for Direct Sidekick is a tax deduction for your business. It is categorized as an office expense. Let us know if you have any other questions. Thank you!

If I placed a personal order under a party, do I count my discount as income?

Hi Kayla!

Great question! If you place an order and do not earn a commission, you do not count the discount as income; it is just a discount. However, if Norwex pays you your commission, that commission is income. For example, if you order $100 worth of products and only pay $65, there is no commission paid and, as such, no income. If you pay $100 for the products and then Norwex pays you the $35, that $35 is income.

Let us know if you have more questions. Thank you!