One of the amazing benefits of being a direct sales consultant is the ability to deduct part of your home and home utilities from your taxes!

The home office deduction (or work-from-home tax deduction as some call it), as well as the mileage deduction, will typically be your top tax deductions unless you hold inventory.

So, don’t forget your home office deduction and you will pay less in taxes.

What Are the Requirements for the Home Office Deduction?

If you are a direct seller who works from home, you should be able to deduct your home office. The IRS has specific home office deduction requirements; we’ll call them tests to determine whether you can write off your home office or not.

First, you must use the space ONLY for your business (an exception is below). So if your “desk” is the dinner table that is obviously used for family meals, you cannot write off this space.

Also, this space must be your primary place of business.

Direct sellers can claim this as their primary place of business even though we do home parties and vendor events.

Second, you must use your home office on a regular basis to perform work. Do you regularly do your calling and administrative work in this room?

The exception to this is if you store inventory in a room that is a shared-use room, you may write off that space.

For example, say you’ve turned your den into your inventory storage area; you may deduct this from your taxes.

What Exactly Can Be Written Off for the Home Office Deduction?

There are two methods for calculating the deduction amount.

The first is the Regular Method. With this method, you are able to write off a percentage of your expenses as well as the total cost of repairs to the part of your home used for business (e.g., paint for the home office). These include:

- Rent, if you rent your home

- Mortgage interest and property taxes, if you own your home

- Home / rental insurance premiums

- Electricity

- Natural gas

- Garbage

- Internet

- General repairs and maintenance on your home

- The full cost of repairs done on your home office

Let’s look at an example.

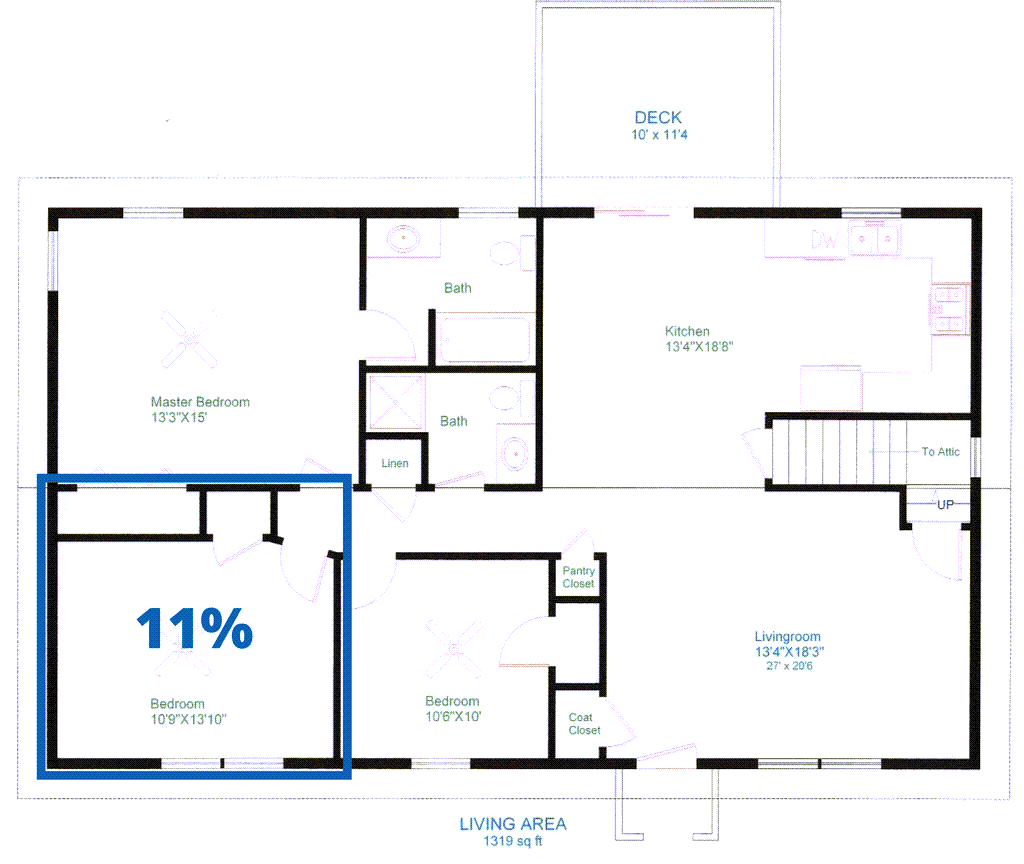

If this is my house and the highlighted bedroom was devoted to my business, I will be able to write off 11% of the cost of expenses listed above.

This was figured by dividing the square footage of the room by the square footage of the whole house.

Home Office Deduction Worksheet

The second method, the Simplified Method, is very simple. Basically, you are allowed to write off $5 for every square foot of your home office.

In the above example, you would be able to deduct $745 (149 square feet x $5) from your business taxes.

There is a limit of 300 square feet for this option, so the deduction with this method maxes out at $1,500.

Which home office deduction method should you use?

The method that allows you the largest deduction for that year, of course! You can change the method used each year to maximize this deduction.

You might be thinking, how can I write all of that stuff off from my taxes?

Think of it this way, if you went out and rented an office to run your business, you would have to pay rent as well as all of these other expenses.

When running your business at home, you get to write the same things off.

Pretty great, huh?

How Can the Home Office Deduction Increase Other Write-Offs?

Simply put, if your home office is your main place of work, whenever you drive to the post office (for work reasons), a home party, a vendor event, or to meet a potential new recruit, you can write off the mileage for that trip!

The IRS does not allow you to deduct personal commuting (IRS Commuting Rule).

However, if you have a home office that qualifies as a principal place of business, you are allowed to deduct your mileage from your house to those locations.

Are There Limitations to the Home Office Deduction?

There are a couple of limitations with the home office deduction.

- There is a limit to how much you can deduct. With either method, you cannot deduct more than you make with your business. This means that taking this deduction cannot turn your company into a negative earning business. However, anything in excess of this limitation can be carried over to future years when you use the regular method.

- If you use the simplified method losses in excess of the limit (#1 above) cannot be carried over to future years.

Important Disclaimer: Everybody’s tax situation is different. What may be right for one person’s situation may not be best for another’s. Please consult a qualified accountant to discuss which method is best for your personal situation.

FYI: Direct Sidekick is accounting software built for direct sellers, network marketers, crafters, vendors, VRBO owners, and many other home-based business owners. Create an account and start tracking your income, expenses, and inventory.

I was under the understanding that the space you call an “office” or store inventory has to have a door and is only used for that use. Not a multi use area. Is this incorrect?

Hi Robin! There is an exclusive use test for your office where the space must be exclusively and regularly as your principal place of business. This means you can’t count your kitchen as your office even if you work at your kitchen table because that is not the exclusive use of the space. There is no requirement for a door or a partition.

Beyond that, if you use part of your home for storage of inventory or product samples, you can deduct expenses for the business use of your home without meeting the exclusive use test.

https://www.irs.gov/pub/irs-prior/p587–2024.pdf

Hi Robin! There is an exclusive use test for your office where the space must be exclusively and regularly as your principal place of business. This means you can’t count your kitchen as your office even if you work at your kitchen table because that is not the exclusive use of the space. There is no requirement for a door or a partition.

Question…if I deduct for my home office, do I have to re-capitalize that when I sell my house? If so, is it worth taking the deduction in the first place?

Great question Jessica! You do not have to re-capitalize if you use the simplified method. If you use the standard method, you will pay tax only on what was depreciated.

The use of a room to store your inventory was a bit vague. If inventory is stored in a shared use room, you would still have to calculate the amount of square footage used in the room for inventory storage, correct? It would not be the total square footage of that room?

Hi Lindsay! Thank you for your comment! Here is a link to the IRS business use of home publication that speaks directly to that. You would use the square footage of the area used for your business not the total square footage of the room.

I am confused on what is considered an expense, supply and for demo. I am with Chalk Couture, and we purchase transfers, surfaces, pastes, squeegees, wax and inks. We demo via LIVE on FB, or in person at gatherings or vendor events. I have items that I purchased to use during a demo. Is that an expense or supply? What is the difference between office and supply? Is it the same? What are the categories for deductions? I currently have an accountant that does my taxes, but would like to save the fees and do my self.

Thanks for your time.

Kathy, check out this article https://directsidekick.com/direct-sales-tax-deductions/. It should answer your questions. Thanks!

Are these articles current? 2018

Kathy, thank you for your question. Yes these articles are current. We regularly review our articles to keep them up to date, especially with the ever changing tax landscape.